Sustainability is a key consideration in CBL Life’s long-term strategy. We recognize the importance of Environmental, Social, and Governance (ESG) factors in shaping responsible business practices and investment decisions. As a Citadele Group company, CBL Life is committed to adhering to the Citadele Group's ESG policy, ESG risk and other sustainability-related policies. For Citadele Group, sustainability means developing business in accordance with social, environmental and economic goals. This includes respect for the environment and responsible and ethical practices in the decisions we make, the products we offer and the services we provide. CBL Life supports this kind of approach and acts within the business framework to achieve the Citadele Group`s goals on the domain of ESG.

CBL Life provides information on the sustainability of insurance products, while the information on sustainability at the entity level coincides with the information of the Citadele Group, which is reflected in the annual Sustainability Reports, because at the entity level we work together in sustainability-related activities.

Citadele Group’s Sustainability Strategy

Citadele Group has committed to align its operations and portfolio with the goals and the timeline of the Paris Agreement and has set the goal of achieving net-zero carbon emissions by 2050. To reach the ambition, the Citadele Group will focus on:

- Financing the climate transition.

- Sustainable own operations.

- Climate risk management enhancement and adaptation to climate-related challenges.

Citadele Group’s largest environmental impact comes from financing and investing activities. At the same time, it is no less important to ensure that our own activities and consumption are sustainable. We aim to minimise the negative and maximise the positive impacts on the environment and society while managing Citadele Group's environmental risks and opportunities.

The Citadele Group’s sustainability strategy is structured around UN Sustainable Development Goals (SDGs) framework. We have prioritised five of the SDGs that are linked to business strategy and sustainability work, and which are in the areas where the Citadele Group have the largest opportunity to make an impact.

The five prioritised goals include:

- Good health and well-being (SDG 3).

- Affordable and clean energy (SDG 7).

- Decent work and economic growth (SDG 8).

- Industries, innovation and infrastructure (SDG 9).

- Climate action (SDG 13).

Aligned with the nature of its activities, CBL Life prioritizes the third SDG - ensure healthy lives and promote well-being for all at all ages.

Citadele Group regularly monitors changes in the business environment and regulatory enactments in order to provide up-to-date disclosure to its stakeholders.

Further relevant information regarding the Citadele Groups sustainability strategy and its relevant aspects is disclosed in AS Citadele banka in its Annual Report for 2024 and in ESG policy 2024. The Citadele Group's Sustainability Report has been prepared in accordance with the requirements of Directive (EU) 2022/2464 of the European Parliament and of the Council on Corporate Sustainability Reporting (CSRD) and the European Sustainability Reporting Standard (ESRS), as well as the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD).

Sustainability Risk Integration into Insurance Products

Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential negative impact on the value of the investment or the liability. These risks may arise from events such as climate-related natural disasters, environmental pollution, social inequality, or poor corporate governance. If not properly managed, such risks can lead to increased costs, reduced investment returns, reputational damage, or other financial consequences.

Sustainability factors mean environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters that have an economic impact on the value of financial assets. These factors can have a significant impact not only on the current situation but also on the quality of life and opportunities of future generations.

CBL Life shares the view that sustainability factors can influence the value of the Company’s investments in the long term, and that by integrating ESG aspects into asset management, investment returns over the long term may increase or remain stable while maintaining a lower overall risk level. Moreover, by integrating sustainability factors into the asset management of insurance products, we contribute to the sustainable development of the world.

CBL Life has entrusted the management of the funds to IPAS CBL Asset Management (hereinafter referred to as the Asset Manager). CBL Life has adopted the Asset Manager's "Sustainability and Engagement Policy" (February 2024, version 5.0) as its binding document for sustainability risk management. This decision is based on the specific nature of CBL Life’s investment operations, as in practice, within the offering of CBL Life insurance investment products, clients are provided with the opportunity to invest only in the investment funds of the Asset Manager, while CBL Life itself does not participate in the investment decision-making process. The Asset Manager is signatory of the United Nations-backed Principles for Responsible Investment, improving governance processes and including ESG factors in the investment process. The Asset Manager integrates sustainability factors into investment decision-making by applying both negative (exclusionary) screening and positive (best-in-class) screening, depending on the specific investment product. The Asset Manager discloses information on the implementation of the engagement policy on an annual basis - available here (2024, version 1.0).

The following table contains links to the pre-contractual documents for each investment product, which discloses how sustainability risks are integrated into decision-making, how sustainability factors are taken into account, how sustainability risks are managed, and whether the principal adverse impacts are considered for the respective investment product.

More information on sustainability in the investment funds offered can be found at:

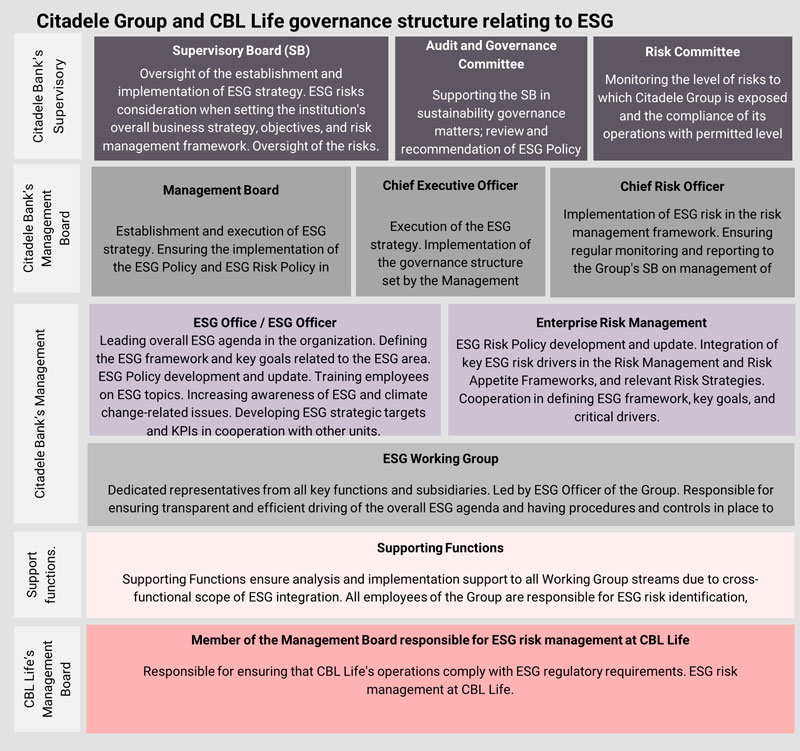

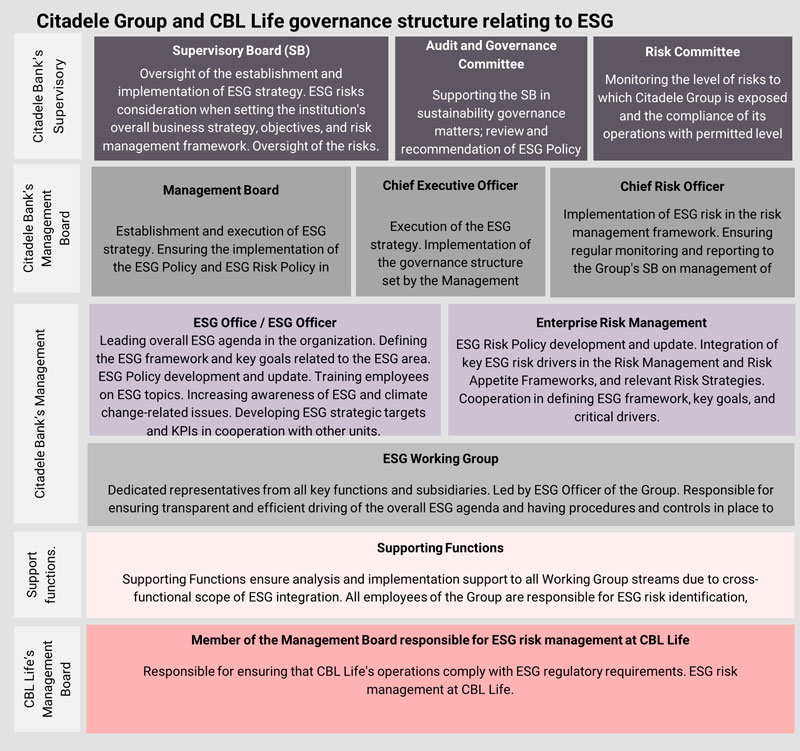

Involvement and responsibility of organizational structure functions in the field of sustainability

CBL Life has appointed a responsible member of the Management Board to manage sustainability risks within the company. ESG factor management is included in the functions of the various Citadele Group structural units, which are shown in the following table:

CBL Life's Management Board member responsible for ESG risk management is actively involved in Citadele Group working groups related to sustainable initiatives, contributing to the development and implementation of strategic frameworks. This provides an opportunity for CBL Life to be involved in the action plan to achieve the objectives set at Citadele Group level.

We acknowledge that the application and integration of ESG criteria involves a risk of greenwashing. Greenwashing is creation of a false impression or provision of misleading information that causes or may cause an investor to believe that the relevant investment products are environmentally friendly or have a greater positive impact on the environment than they actually have. To avoid the risk of greenwashing, CBL Life and Asset Manager strictly adhere to all applicable legal and regulatory requirements related to the identification, management, and disclosure of sustainability risks and ESG factors. All sustainability-related statements and disclosures are based on transparent methodologies, and are aligned with the requirements set by the Regulation (EU) 2019/2088 of the European Parliament and of the Council on sustainability-related disclosures in the financial services sector (SFDR) and other relevant EU legislation.

The SFDR requires insurance undertakings to classify each of their insurance products as a product of Articles 6, 8 or 9 of the SFDR and to disclose certain information in accordance with this indication in order to provide greater transparency to members before investing:

- Article 6 SFDR insurance product – a financial product with no sustainable investment objective and no obligation for investments in assets with environmental and/or social benefit, i.e. an insurance product that does not qualify as an Article 8 or Article 9 SFDR insurance product.

- Article 8 SFDR insurance product – a financial product that promotes investments with a beneficial/positive impact on environmental and/or social performance. Such promotion may contain exclusion of certain environmentally and socially harmful economic activities or consideration of relevant ESG rating when making investment decisions.

- Article 9 SFDR insurance product – a financial product that has sustainable investment as its objective, aiming to achieve specific environmental and/or social goals, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices.

When choosing a Conservative, Balanced or Dynamic Investment strategy, the funds are invested in the SFDR Article 6 financial products. When choosing the Dynamic+ investment strategy, 70% is invested in SFDR Article 6 and 30% SFDR Article 8 financial products.

No consideration of adverse impacts of investment decisions on sustainability factors

For the time being, there is a lack of accurate, timely and reliable information on the impact on sustainability factors in securities issuer companies, as well as due to the limited resources of the Asset Manager and the small share of investments in the assets of issuers, CBL Life does not consider the principal adverse impacts of investment decisions on sustainability factors at the entity level. The principal adverse impacts on sustainability factors are considered by the Asset Manager at the product level when managing the SFDR Article 8 investment fund CBL European Leaders Equity Fund.

The Asset Manager follows changes in the availability of information and the position to consider principal adverse impacts in the investment process will be adapted as soon as its meaningful and practical implementation is possible.

The underlying investments in the insurance products offered by CBL Life do not take into account EU criteria for environmentally sustainable economic activities.

Information updated on May 19, 2025.